Estate Planning Attorney - Truths

Estate Planning Attorney - Truths

Blog Article

An Unbiased View of Estate Planning Attorney

Table of ContentsSee This Report on Estate Planning AttorneyOur Estate Planning Attorney DiariesFacts About Estate Planning Attorney UncoveredIndicators on Estate Planning Attorney You Need To Know

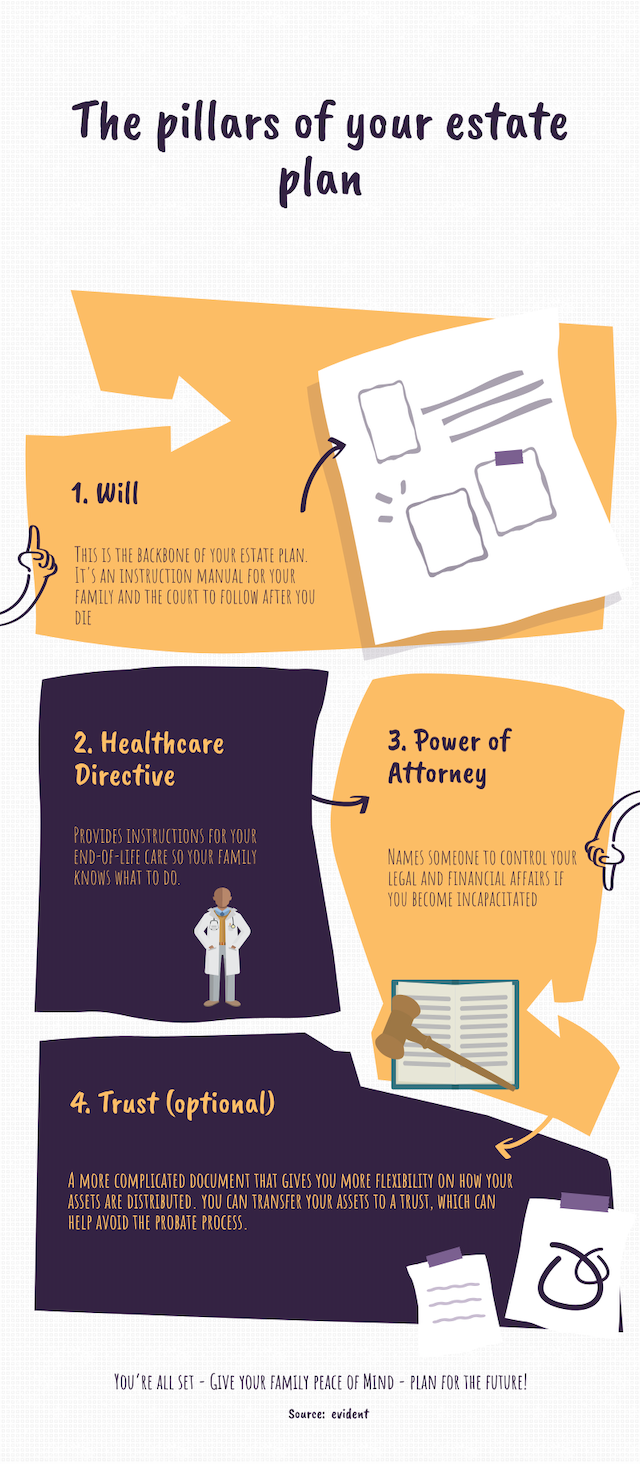

Estate preparation is an activity plan you can make use of to establish what happens to your properties and commitments while you live and after you pass away. A will, on the other hand, is a legal paper that outlines how possessions are dispersed, who looks after children and pets, and any other desires after you pass away.

The administrator additionally needs to repay any type of tax obligations and financial obligation owed by the deceased from the estate. Creditors generally have a restricted amount of time from the day they were notified of the testator's fatality to make claims versus the estate for money owed to them. Insurance claims that are rejected by the administrator can be taken to court where a probate court will certainly have the final say as to whether or not the insurance claim stands.

Get This Report on Estate Planning Attorney

After the supply of the estate has been taken, the value of assets calculated, and tax obligations and financial debt paid off, the executor will then seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any type of estate tax obligations that are pending will certainly come due within 9 months of the day of fatality.

Each private areas their properties in the count on and names somebody aside from their spouse as the beneficiary. A-B depends on have actually become less popular as the inheritance tax exception functions well for the majority of estates. Grandparents might move properties to an entity, such as a 529 strategy, to sustain grandchildrens' education.

10 Simple Techniques For Estate Planning Attorney

This technique includes cold the worth of a possession at its worth on the date of transfer. Accordingly, the quantity of prospective capital gain at fatality is also iced up, allowing the estate organizer to estimate their possible tax obligation upon fatality and better plan for the repayment of income tax obligations.

If sufficient resource insurance earnings next page are readily available and the policies are properly structured, any type of income tax on the regarded dispositions of properties following the death of a person can be paid without turning to the sale of properties. Proceeds from life insurance policy that are received by the beneficiaries upon the death of the guaranteed are generally earnings tax-free.

Other charges connected with estate preparation include the prep work of a will, which can be as low as a few hundred bucks if you make use of one of the best online will certainly manufacturers. There are certain papers you'll require as component of the estate planning process - Estate Planning Attorney. Some of one of the most usual ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is just for high-net-worth people. Estate intending makes it less complicated for individuals to identify their wishes before and after they pass away.

Fascination About Estate Planning Attorney

You need to begin planning for your estate as quickly as you have any quantifiable asset base. It's a recurring process: as life proceeds, your estate strategy should shift to match your scenarios, in line with your brand-new goals.

Estate preparation is frequently thought of as a device for the wealthy. That isn't the situation. It can be a useful method for you to manage your properties and obligations before and after you pass away. Estate planning is additionally a terrific means for you to lay out prepare for the care of your small youngsters and animals and to describe your want your funeral and preferred charities.

Qualified applicants who pass the test will be formally certified in August. If you're qualified to sit for the examination from a previous application, you might file the brief application.

Report this page